This blog will discuss the analysis of Related Party Transactions (RPT) by the MNC stocks. We will see the practical aspects of analysis discussed in the last blog. I will consider transactions from some listed companies as examples.

This kind of analysis is very exhaustive with no boundaries. However, in this blog, I cover the below most common transactions/checkpoints:

- Purchase of Raw Materials from a Related Party

- Loan to Related Party

- Check the Auditor’s Report

- Check for Shareholder approval

- Purchase of Assets from a Related Party

You can use a similar approach for the analysis of other RPT.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Purchase of Raw Materials from a Related Party

We will see a broader overview of this analysis, though the focus is on transactions related to the purchase of raw materials. You need to review the Related Party Transactions section for transactions with Holding companies and fellow subsidiaries.

Note: The transaction with a direct subsidiary is ignored as it does not benefit the Parent/Holding company.

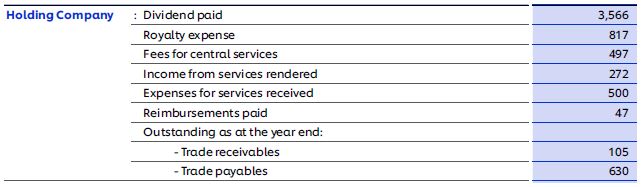

Holding Company

The high-value transaction would be around Royalty and Dividends. Dividends can be ignored as it applies to all stakeholders. Royalty can be analysed as covered in my three earlier blogs. In the below sample, there are other transactions that are fees for some services received. As mentioned in my previous blog, the RPT does not have sufficient details to know the exact nature of service received.

Fellow Subsidiaries

On reviewing the list of items it can be seen that there is no loan given to fellow subsidiaries. There are many transactions in the image. You need to focus on high-value transactions. The biggest figure in the table is the Dividend paid. This dividend is paid for the stakes the fellow subsidiaries hold in the Indian listed entity. The details can be seen in the image below.

The next biggest is the purchase of raw materials. It is around 758 Crores (The value above 1,088). This need to be analysed further. On the next page is the disclosure of transactions with a value of more than 1% of revenue.

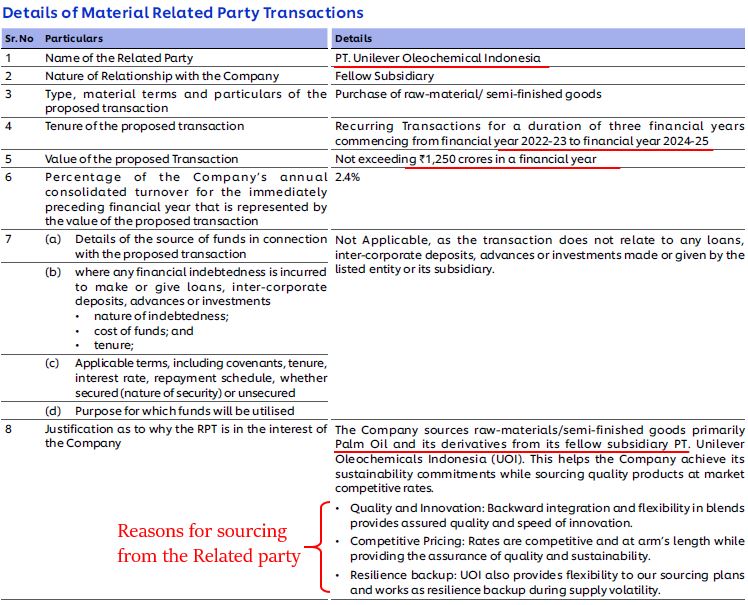

It can be seen that the Indian-listed entity has purchased some raw materials from its fellow subsidiary in Indonesia. How to analyse this? You need to find out what “PT Unilever Oleochemical Indonesia” is doing. What are they supplying to the Indian listed entity?

How can this be done? Search the annual report for “PT Unilever Oleochemical Indonesia”. Review each search result and one of the occurrences gives the needed details.

Inference

The following details emerge from the search:

- There is a contract to buy finished and semi-finished goods for a period of 3 years to a maximum value of 1,250 crores a year.

- It is a wholly owned subsidiary of the parent company and a fellow subsidiary of the Indian-listed entity

- The transaction is for the purchase of Palm-oil

- Reason to buy from fellow subsidiary: Quality, lower price and stability of supply.

How to interpret this?

- Palm oil is an essential raw material for the manufacture of FMCG products.

- India as a country is a net-importer of Palm oil mainly from Indonesia and Malaysia.

- The Indian listed entity is buying this raw material from its fellow subsidiary directly rather than from another entity from India, which again would import from Indonesia or Malaysia.

- This arrangement could be mutually beneficial to both the Indian listed entity and its fellow subsidiary.

- The company is not buying an item from its fellow subsidiary which is readily and abundantly available in the Indian markets.

This transaction appears to be clean. Though the details of volumes and unit price is not available, one can form an opinion that the transaction is NOT done to benefit the related parties.

This transaction appears to be clean. Though the details of volumes and unit price is not available, one can form an opinion that the transaction is NOT done to benefit the related parties.

Just to drive a few insights, let me consider the contra situation.

If suppose palm-oil is abundantly available in India, then this transaction would raise eyebrows. You should then ask why should the company import from its fellow subsidiary in Indonesia when it is abundantly available in India.

Transaction Value

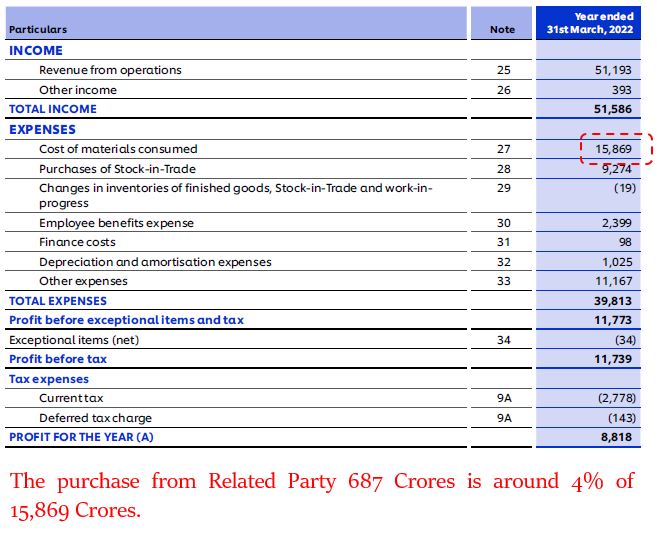

The second part of the analysis is to see the significance of the value transacted. This value is compared to the total purchase of raw materials. The total purchase details can be found in the Profit & Loss statement. In this case, it is around 4% of the total purchase of raw materials. Opinion: Transaction forms a small portion.

On the contrary, if this was some 50% of the total spend on raw materials then it is a concern. Since almost half, the needed raw materials are brought from fellow subsidiaries. Without details of the unit price, you have no means to conclude if this was in the best interest of the related party or the Indian listed entity.

Loan to Related Party

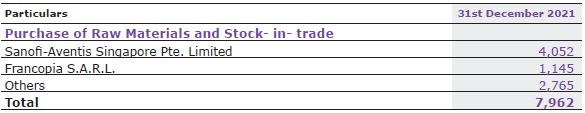

Follow a similar approach as in the above example. Locate the “Related Party Transactions” section and review all the transactions. In the previous example, we discussed the analysis of “Purchase of raw materials”. In this example too it can be seen that the company does transactions on the purchase of raw materials.

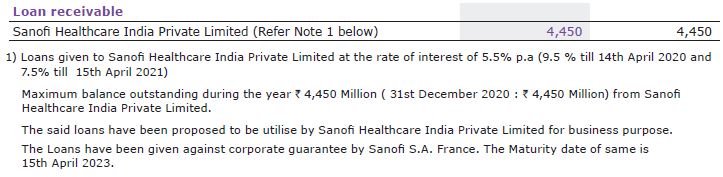

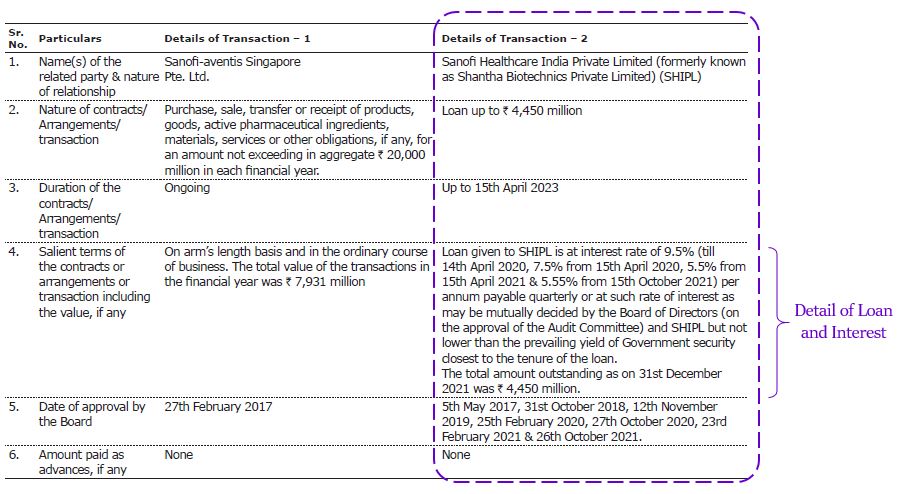

In this part, we will focus only on loans given to the related party. Towards the end, you can find the Indian listed entity has given a loan of 4,450 Million INR. The note below the table carries some information about the loan and interest rates charged over the loan.

In order to know more, you need to search for details of the entity “Sanofi Healthcare India Private Limited”.

Inference

What to infer from the search results?

- The Indian entity has been charging different interest rates for different years aligning with the prevailing interest.

- The last revision was in October 2021, with the interest rate fixed at 5.55%.

- The rates would be revised periodically, and management is clear that it would not be lower than the prevailing yield on Government securities

- The loan will be repaid on 15th April 2023.

How to see this transaction?

The first question to ask is why has “Sanofi Healthcare India Private Limited” not taken a loan from the bank directly. The possible reasons could be:

- Sanofi Healthcare India Private Limited, may not be having the needed creditworthiness or the limits to the extent of borrowing 4,450 Million INR.

- The interest rates for business loans would be significantly higher than the yield on government securities. However, in case of this loan, the related subsidiary is paying interest aligning to yield on government securities. Thus, this transaction benefits the related party.

- Then was this against the interest of the Indian-listed entity? The answer could be more hypothetical. It would depend on where the company would have invested this loaned money.

The second question is why the parent entity not giving this required loan to its subsidiary “Sanofi Healthcare India Private Limited”, but making another fellow subsidiary give it.

- Whether the parent company does not have sufficient funds? A very simpler means to check is to see the dividend received from the Indian entity.

- Which in this case is 5,075 Million INR. This was more than sufficient to cover the loan requirements of “Sanofi Healthcare India Private Limited”.

The clear inference is that the parent company is not giving out from its account but rather transfers from one subsidiary to another.

You have one clear message on corporate governance! However, remember that this is just one pointer and not a complete analysis to form a judgement about the corporate governance of the company.

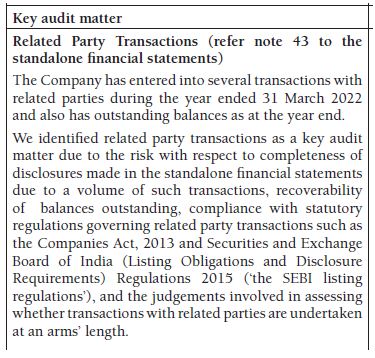

Check the Auditor’s Report

Review the comment by Auditor in the “Auditor’s Report”. Do read my earlier blog where I have discussed the insight that Auditor’s Report share. They would flag their observations which would give some insights. One example is the case of MNC stock where the Auditor has raised concerns about RPT.

Check the Shareholder approval

The RPTs are put to shareholder’s approval based on the size of the transaction. The defeat of the resolution indicates that the transaction was to benefit the related party and not in the best interest of minority shareholders. Here you get an indicator of parent company intentions and corporate governance. Below is a sample of where such resolutions were defeated.

Source: Report titled, “MNCs and royalty: Me Before You?” by Institutional Investor Advisory Services.

We will see the practical aspect of this analysis in the next example.

Purchase of Assets from a Related Party

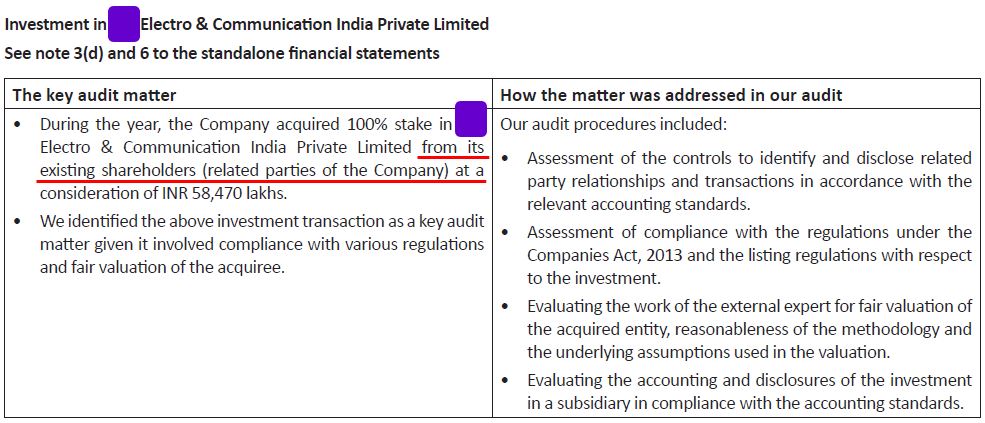

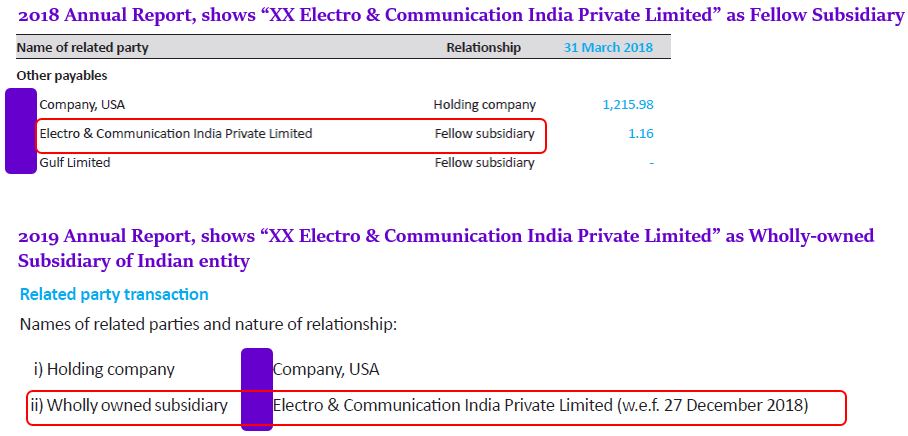

This example will focus on the purchase of Assets from a related party. The said company has invested in a subsidiary, “XX Electro & Communication India Private Limited”. Interestingly this is the highest-value transaction in the list.

To understand this investment, you can search the annual report for “XX Electro & Communication India Private Limited”. The auditor’s report shows one result where the auditor commented on this transaction. It can be seen that the subsidiary was purchased from a related party.

To know who is the related party, we check for the same entity “XX Electro & Communication India Private Limited” in the current and previous year’s Annual Reports. In the previous year, it was a fellow subsidiary of the Indian entity. “XX Electro & Communication India Private Limited” was held by the parent company. In the current year, this has become a direct subsidiary of an Indian entity.

Inference

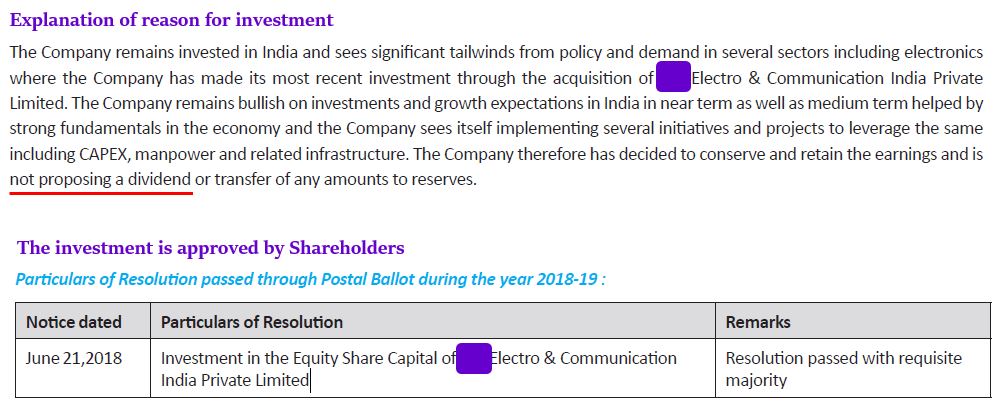

The Indian entity has brought one of the subsidiaries of the holding company. Towards this, the Indian entity has paid 584.7 Crores to the parent company. Why did the company do it? The answer also would come from the annual report.

From the above image, we can understand:

- The Indian-listed entity has shared its reasons for the acquisition

- It is not proposing any dividends (As an added note, this company has not declared any dividends in the past)

- The investment has gone through shareholder approval as well.

- The auditor in his report has not flagged any concern over the transaction.

What questions should you ask?

- Is the acquisition of the subsidiary aligned with the core business of the Indian entity? – For this, you need a good understanding of the business of the subsidiary and the Indian-listed entity

- Was the acquisition overvalued? (or) What is the valuation rationale for paying 584.7 Crores to the parent company? – The subsidiary being an unlisted entity, would not have its financial statements in the public domain. You can ask for the valuation report (Basis of which this transaction was made) from the Indian-listed company.

- Did the related party gain? Ask if yourself, If the subsidiary “XX Electro & Communication India Private Limited” is a great business, why does the parent company even sell it? In the transaction, a sizeable amount has moved from the Indian-listed entity to the parent company. Since the company never pays dividends, is this the channel used by the parent company to move the financial resources from the Indian-listed entity to itself?

Inconclusive Opinion

This is a case where it is difficult to form a conclusive opinion. Still, there are a few things that an investor could do to get answers.

- Was this transaction a one-kind or first of its kind? The investor needs to find if the Parent company develops new subsidiaries in India and after sometime, sells it out to the Indian entity. Then repeat the same cycle by developing another subsidiary. The answer to this can be found by checking the annual report of the last 10+ years. If there is a pattern, then it is a question of its corporate governance.

- The second thing is to see the financial performance of “XX Electro & Communication India Private Limited” in future.

To close…

You can use a similar approach in analysing different RPTs. You need to search the annual report for more details, ask the right question to gather the right inference and form an opinion on corporate governance.

The series on MNC stock analysis related to Royalty and Related party transactions ends.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

excellent content on your website

kindly upload these kind of these content which are helpful