In our earlier blog, we saw that the view of MNCs having the highest corporate governance standards is debatable. This view could be more of a perception. Two areas where one can get insights about corporate governance are, (1) Royalty pay-outs and (2) Related Party Transactions. I discussed Royalty in my earlier three blogs.

- Royalty payments to overseas parents, investor concerns and views of the investment community

- Tools to Analyze Royalty – Part 1

- Tools to Analyze Royalty – Part 2

This blog will cover the second area, Related Party Transactions (RPT). To understand this blog better, you will need to understand a bit about RPT. Since this blog is not about RPT, I would not cover this in depth. I reserve the in-depth discussion of RPT on a future blog. I have covered only to the extent needed to understand the RPT by MNC companies. (Featured image credits)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Overview of Related Party Transactions

What are Related Party Transactions?

Related Party Transactions (RPT) involve the transfer of resources, services or obligations between the reporting entity (The company you are analysing, which in this case is the MNC stock) and a related party, regardless of whether a price is charged.

Who are the different related parties?

An exact definition of a related party is tricky. Simply put, it is a person or entity with controlling authority over the listed entity or is related to them. The different related parties are:

- Director / Relatives to Director

- Key Management Personal / Their relatives

- Holding Company

- A Subsidiary Company

- An Associate Company and many more

The complete list of all related parties can be had from the source: https://www.mca.gov.in/Ministry/notification/pdf/AS_18.pdf

Why is this important?

Unlike the transaction with third parties, this happens between the listed entity and another person/entity closed associated with the listed entity and has controlling authority. The transaction could at times not be in the best interest of all stakeholders i.e. Minority shareholders and benefits the related party.

A word of caution here. RPT does not necessarily indicate a fraudulent financial transaction. A transaction could be legitimate. Investors need to evaluate it to get a bigger picture of corporate governance. It helps to understand the attitude of the parent entity and its commitment to minority shareholders.

Let us see a few possibilities (or rather creativity) in RPT, which may not be in the best interest of all minority stakeholders of a company.

Creative areas in Related Party Transactions

- Purchase: The listed company can buy raw materials or fixed assets from related parties at higher than market cost.

- Lease/Rent: The listed company can avail lease or rent facilities from related parties at higher rates.

- Concessionary Loans: Lend loans to a related party at low-interest rates than market rates. Sometimes no interest could be charged.

All the above leads to the transfer of money from the listed entity to related parties. This financially benefits the related party. The reverse of the above also would be possible:

- Sale of raw material/fixed assets to a related party at lower than market prices

- Taking loans from related parties at higher interest rates

- Lease/rent the facilities to a related party at lower prices.

In all these transactions money is transferred from the related party to the listed entity. However, the nature of transactions is such that it financially benefits the related party.

Challenges in Analysis

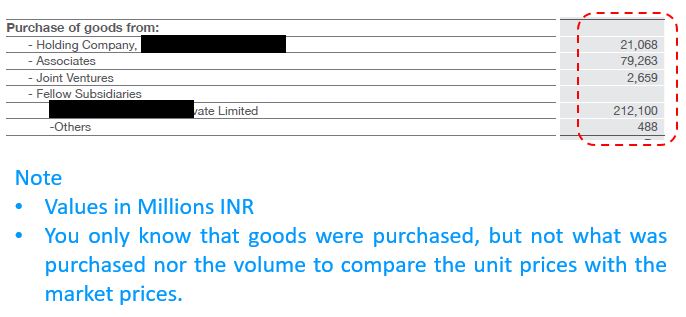

The Annual report covers the RPT in detail. However, it does not cover details to the extent, that one can confidently make out if the transaction was legit or a fraud. Say if the transaction was on the purchase of raw materials, a single line item exists for the overall value of the transaction that had happened that year as in the sample below.

This would not be adequate to conclude if the purchase of raw materials from the related party was done above the market prices. Finer details about the volume of raw material transacted, and its market price is needed to judge if the transaction benefitted the related party.

Even with the available information, it is still possible to form some judgement. You need to ask a few questions and comparisons to form an opinion. These questions could go this way.

- What is the raw material commonly used by the company?

- Is that raw material easily available in the market? If:

- No, then the RPT has a business case. The listed entity company has fewer options in the open market and purchases from a related party.

- Yes, then why should (or what compulsion) the listed company buy it from the related party?

- What is the size of such a transaction in comparison with the overall raw material purchase? If the size is negligible then it can be ignored. However, if it is not negligible and you do not have any other detail to form a judgement then you can ask for the details from the management in the concalls.

Note: We will see the practical aspect of these questions-based analyses in the next blog.

Some RPTs are relatively straightforward to form a judgement. A concessionary loan to a related party is not difficult to judge.

Related Party Transaction of MNC Stocks

The RPT that we specifically focus is the ones that the listed Indian entity has with its:

- Ultimate Holding Company

- Immediate Holding Company

- Intermediate Holding Company

- Fellow Subsidiaries.

The details of these are covered in the previous blog. In case you have not read them already, do check them out for better clarity. We will not analyse the RPT with direct subsidiaries. The reason being the parent company does not benefit financially due to such a transaction between the Indian listed entity and its direct subsidiary.

Also, remember that the RPT with these entities most likely happen in foreign currency.

How to analyze Related Party Transactions

- Look out the annual report for details of related parties like Ultimate/Intermediate/Immediate holding company and fellow subsidiaries – The “How to” of this is covered in my previous blog.

- Go to the “Related Party Transactions” section to review the transaction with the above-related parties

- The Dividend paid to the parent entity/holding company can be ignored as it is paid to all stakeholders

- Analysing the Royalty paid is covered in my three earlier blogs

- Focus on big-ticket value transactions against the smaller ones

- With the available details try to form an opinion by asking basic questions or comparing the value of the transaction with other related figures in the financial statements.

A few things to remember

- You might not find all the answers that you are looking

- This makes it difficult to form a confident opinion

- More fellow subsidiaries is a concern as it allows many RPT. Note: It does not necessarily indicate fraud.

- Though the Annual report lists many fellow subsidiaries the Indian listed entity may not have RPT with every fellow subsidiary

- This analysis is both a qualitative and quantitative analysis which becomes easier with repeated practice.

We will see a practical overview of these aspects and analysis in the next blog with examples from a few MNC stocks.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.