Annual reports publish three primary financial statements: Cash flow

- The Balance Sheet,

- The Income Statement, and

- The Cash Flow Statement.

In this blog series, I aim to delve into a comprehensive analysis of the Cash Flow Statement, covering everything from its fundamentals to advanced concepts.

Featured image credits: https://corporatefinanceinstitute.com/resources/accounting/cash-flow/

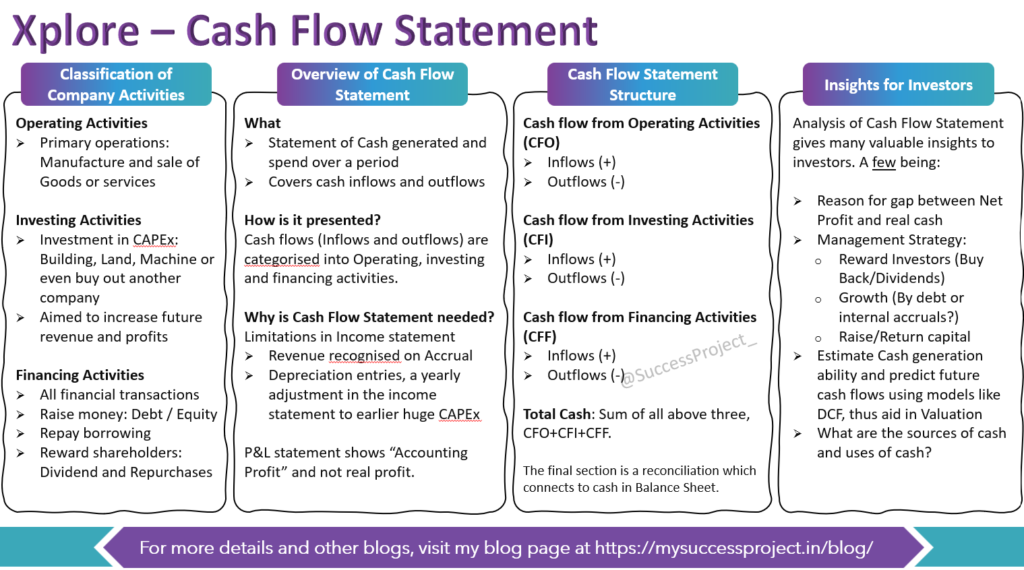

Below is the snap of ideas covered in this blog.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might want to explore my other blogs that also delve deeply into the analysis of financial statements like Debt Equity Ratio, Revenue Analysis and Metrics for Dividend Analysis (Part 1 and Part 2)

- Background for this Blog Series

- Three Main Activities of a Company

- What is a Cash Flow Statement

- Structure of Cash Flow Statement

- Importance of the Three Category Cash Flow reporting

- Walk through with Example

- What is Cash Flow statement needed?

- Importance of Cash Flow analysis for investors

- Conclusion

Background for this Blog Series

In the financial statements, though cash flow statement comes third in the lineup, I always give priority to analyzing the Cash Flow Statement when assessing a new stock. That’s because it provides crucial insights into the company’s performance, financial standing, strategy, and current situation. At times, I’ve observed that examining the Cash Flow statement alongside the Balance Sheet and the Income Statement can alter one’s perception of a company, especially if they’ve only reviewed the Balance Sheet and Income Statement.

Many investors are familiar with the Balance Sheet, Income Statement, and the ratios derived from them, the intricacies of the Cash Flow Statement are frequently disregarded, despite the valuable insights it provides.

By exploring the Cash Flow Statement from A to Z, you will gain a deeper understanding of the company’s strategy around financing, investing and more. Armed with this knowledge, you will be better equipped to make informed investment decisions.

Three Main Activities of a Company

To understand the Cash Flow Statement, it’s crucial to understand the following three fundamental activities common to every company.

Operating Activities

- These activities constitute the primary operations of a company, which include manufacturing and selling goods or providing services.

- For instance, the VST Industry engages in the manufacturing and sale of tobacco products.

- All actions related to purchasing tobacco, manufacturing cigarettes, and selling them fall under operating activities.

Investing Activities

- Companies invest in things like machinery, land, buildings, or other companies to grow.

- These investments help expand the company’s operations and improve its long-term outlook.

- For instance, when VST Industry buys new machinery or builds a factory to boost production, it’s investing in its future revenue and profits.

Financing Activities

- These involve all money-related actions of a company.

- Companies raise capital to pay for operations or investments and also repay debts.

- For example, if VST Industries borrows money to buy machinery, these actions are considered financing activities.

What is a Cash Flow Statement

- A statement that provides information all cash generated and spent during a given period.

- It details all cash inflows and outflows and boils it down to how much cash the company has generated (or spend) in a given period.

- The cash flows are categorised under operating, investing and financing activities.

- Such a classification helps to understand the amount of cash a company is generating or consuming on various activities.

Structure of Cash Flow Statement

The cash flow statement is structured into three sections corresponding to the three activity classifications. Each of these activities generates cash inflow and outflows.

Cash Flow from Operating Activities

- This section outlines cash inflows and outflows generated by the company’s operational activities.

- For instance, cash outflow encompasses expenses such as raw material procurement, salary disbursements, and advertising expenditures.

- Whereas cash inflow comes from sales of products/services.

Cash from Investing Activities

- This segment consists of cash flows from investment-related actions.

- For instance, outflows incurred through the acquisition of fixed assets, while inflows may arise from the sale of existing assets, such as machinery.

Cash from Financing Activities

- Financing activities encompass transactions that alter the size and composition of a company’s equity and debt.

- Examples include raising capital through equity issuance or borrowing, as well as repayments of debt.

Importance of the Three Category Cash Flow reporting

By delineating cash flows across these three categories, the Cash Flow Statement provides investors with a comprehensive understanding of how a company generates and utilizes cash. It offers crucial insights into the company’s liquidity, financial stability, investment decisions, and funding sources, thereby enabling investors to make more informed investment decisions.

Major contribution must come from operations, followed by investing and financing activities. If it is other way round (Operation is less than the other two), then it is an indication that the operation structure of the company is poor, and more examination would be needed.

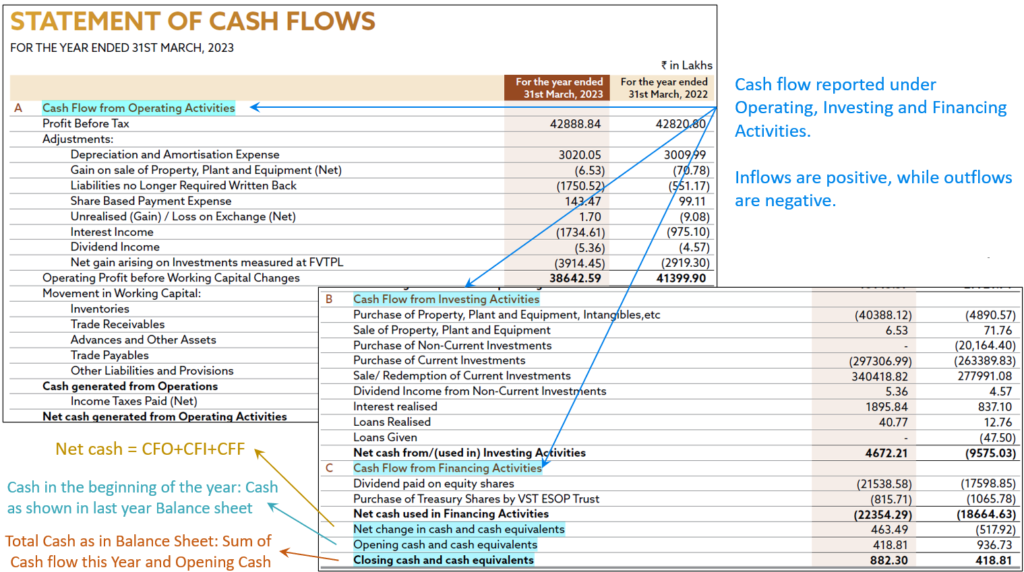

Walk through with Example

We will see an example of whatever we discussed so far.

Total Cash is the sum of cash under the three headings

Total Cash: CFO + CFI + CFF

The final section of the cash flow statement is a reconciliation of the total cash balance, which connects to the balance sheet. This indicates an overall net increase or decrease in cash flow once the total balance from the three sections has been summed up. The closing cash balance becomes the opening cash balance for the next financial period.

Detailed analysis and illustrative examples of each of these categories will be discussed in forthcoming blog posts.

What is Cash Flow statement needed?

While the Balance Sheet and Income Statement serve as vital financial documents, they have limitations. A few of them:

- The Income Statement’s revenue recognition follows the “accrual” concept, recognizing income upon sale regardless of when cash is received.

- Similarly company pays its vendor after a few days, while it records it as an expense in the income statement.

- Depreciation entries in the Income Statement merely represent accounting adjustments for past fixed asset expenditures.

Similarly, there are many such adjustments. Due to all these, the reported “Net Profit” in the Income Statement does not equate to actual cash profits, leading to discrepancies between reported earnings and real cash earned by the company. At times Income statements may show a profit, while it has made loss.

These shortcomings are overcome by the Cash Flow Statement, which offers a more accurate depiction of a company’s financial health.

Importance of Cash Flow analysis for investors

Analysis of Cash Flow Statement is a very important tool in fundamental analysis. When Cash flow statement is analysed with the balance sheet and income statement, you get an outlook on the company’s financial health and management strategy. A few things that an investor gets to know are:

- Accounting and Real Profit

- The Profit shown in the P&L statement is not real.

- Investors must be interested in actual cash profits.

- It is meaningless to rely on Net Profits when the company might actually not be making profits at all.

- The Cash flow analysis helps to understand the reasons for gap between accounting profit in P&L statement and Cash Flow from Operations

- The Analysis provides insights into management’s strategy:

- Rewarding investors (Dividends, Buyback),

- Investing in CAPEx or

- Repaying Debt etc.

- Did the company raise or pay back any capital?

- Which of these activities generates more cash? In the case of matured manufacturing most of the cash must come from “Cash flow from Operation”

- What are sources of cash (Borrowing or equity) and uses of cash (Expansion or working capital)? – This gives insights on Management strategy.

- Cash flow information is useful in assessing the ability of the entity to generate cash and cash equivalents. This enables to estimate future cash flows for valuation purposes using models like DCF.

- Did the company generate sufficient CFO to fund CAPEX and also repay the borrowings?

- If Yes, where was the extra cash used?

- If No, how was the gap managed?

The above mentioned are just a few possibilities. In future blogs, we’ll delve into how to analyze a Cash Flow statement and extract the insights mentioned above, as well as others.

Conclusion

The Cash Flow Statement is a vital tool for investors to gain insights into a company’s financial health and performance. While the Balance Sheet and Income Statement offer valuable information, the Cash Flow Statement provides a unique perspective by focusing on actual cash inflows and outflows. By analyzing the operating, investing, and financing activities outlined in the Cash Flow Statement, investors can better understand how a company generates and utilizes cash, assess its liquidity and financial stability, and make informed investment decisions.

Mastering Cash Flow Statement analysis will help you to unlock valuable insights into a company’s strategy, revenue generation, financing, and investment decisions.

The future blogs will explore the analysis part with real examples from listed companies. Stay tuned!

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Valuable information!

great content, please do important ratios from the cash flow statements