In the fundamental/financial statement analysis, Cash Flow from Operating activities holds a special place. It provides a clear picture of a company’s ability to generate cash from its core operations, offering insights into its financial health and operational efficiency. Understanding how to interpret and analyze Cash Flow from Operating activities is essential for investors looking to make informed decisions about stocks and businesses.

In this blog, we will delve deep into the intricacies of Cash Flow from Operating activities, exploring its importance, preparation, and interpretation. For a better understanding of this blog, please read my earlier blog An Introduction to Cash Flow Analysis.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might want to explore my other blogs that also delve deeply into the analysis of financial statements like Debt Equity Ratio, Revenue Analysis and Metrics for Dividend Analysis (Part 1 and Part 2)

Importance of Cash Flow from Operating Activities

The amount of cash flows arising from operating activities is a key indicator of the extent to which the operations of the entity are generating real cash for the firm.

The CFO should be sufficient to repay loans, reward shareholders and make new investments without recourse to external sources of financing.

Manufacturing companies must have most of their money coming from CFO. Thus the 3-level categorisation (i.e. Operating, Investing and Financing activities) of cash flow statements exposes the companies that are poor in operations and getting money from financing and investing activities.

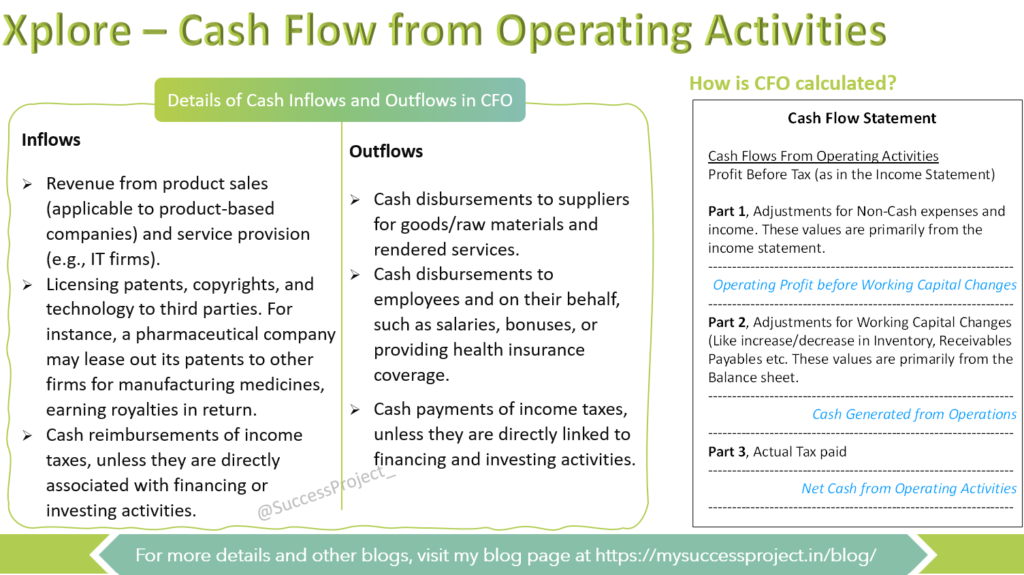

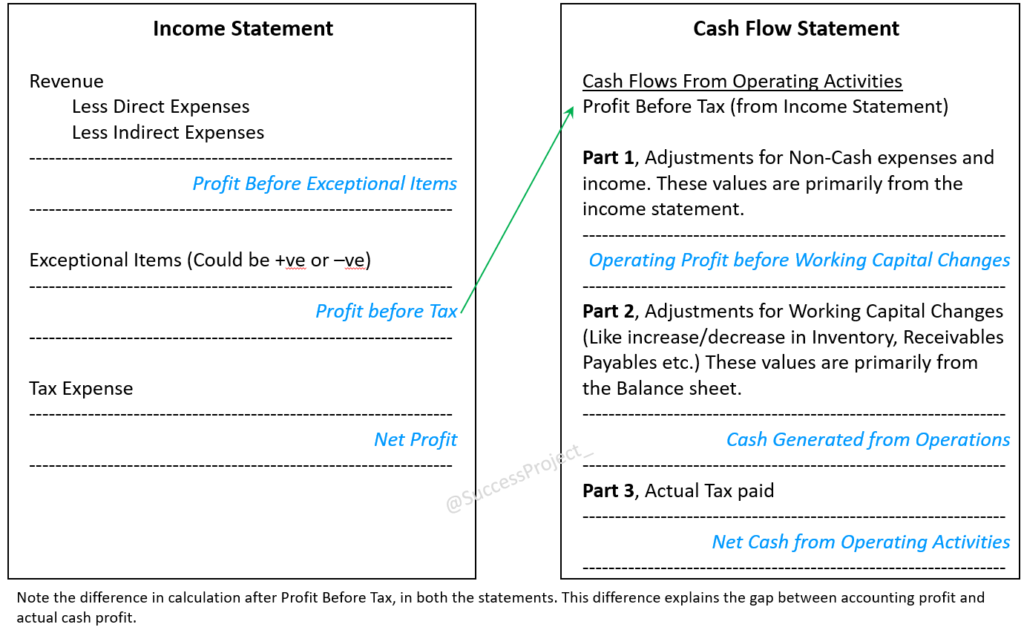

Understanding the Inflows and Outflows

The above is not an exhaustive list. It is only a high level overview. If you wish to know the details of all Inflows and Outflows refer the IND AS7.

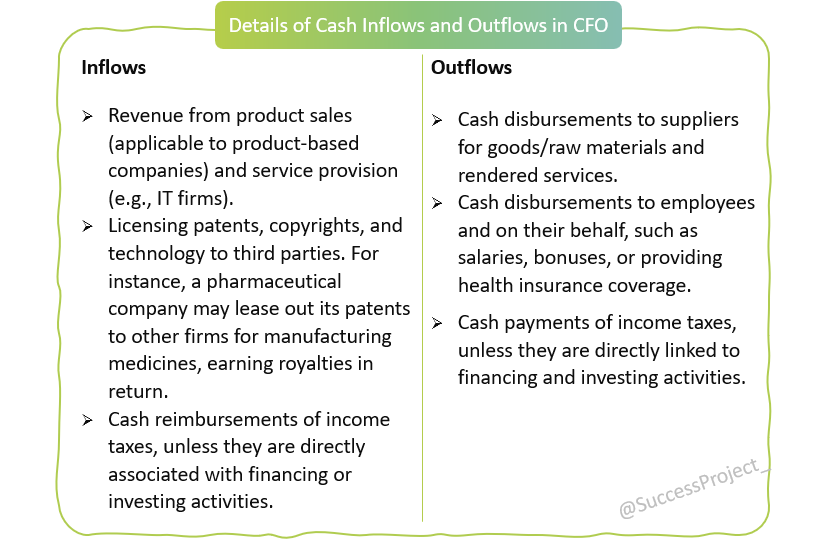

How is Cash Flow from Operating Activities Presented?

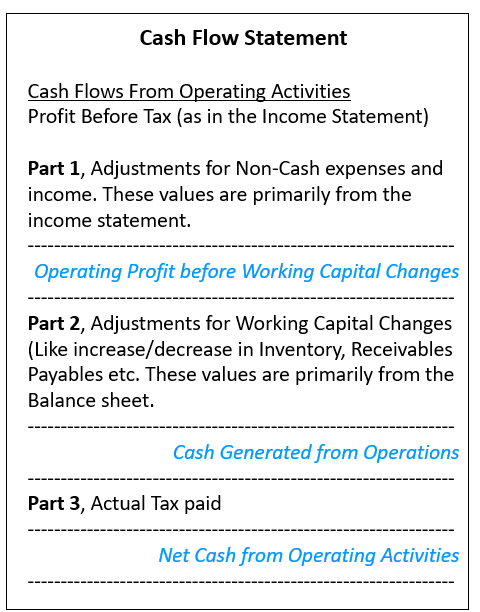

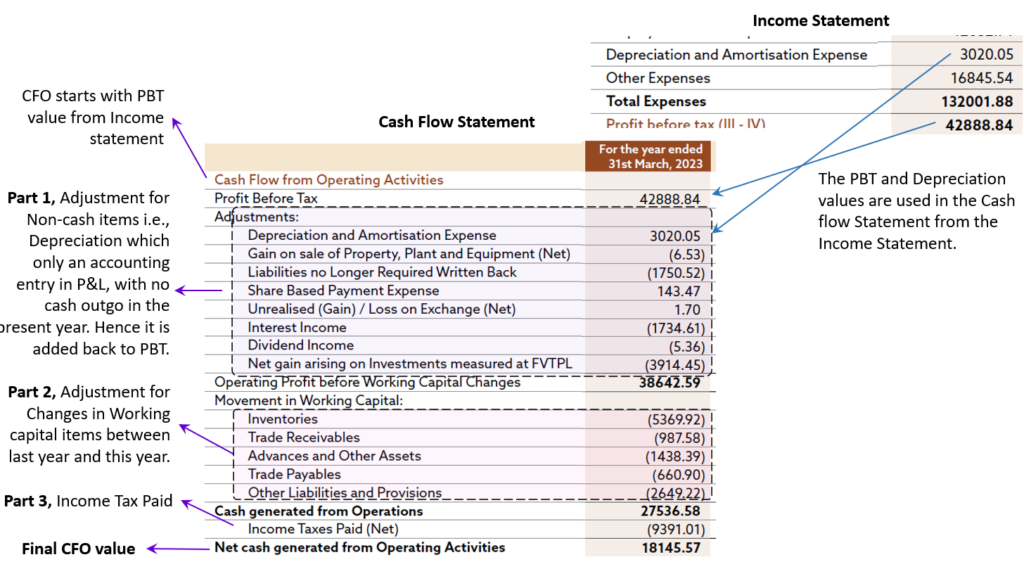

The presentation of Cash Flow from Operating activities differs slightly from those of Cash Flow from Investing and Financing activities. Unlike CFI and CFF, CFO is calculated using figures from the Income statement and Balance sheet. The CFO starts with the Profit Before Tax from the Income statement and makes adjustments based on entries from the Income statement and Balance sheet to obtain the final cash flow from Operations. See the image below for details.

This approach is necessary to determine the true cash generated by the company through its operating activities.

- While the net profit displayed in the Income statement represents accounting profit, it doesn’t reflect the actual cash available to the company.

- The net profit encompasses various non-cash expenses (such as Depreciation) and income.

- When preparing the Cash Flow Statement’s statement of Cash Flow from Operating Activities (CFO), these elements are adjusted to ascertain the actual cash generated from operating activities.

Below is an overview highlighting the key differences between how net profit is calculated from the Income statement and CFO in the Cash Flow Statement.

Conversely, Cash Flow from Investing and Financing activities is presented without any derivation or adjustment from other statements. Although these statements may utilize figures from the Income statement and Balance sheet, there is no process of derivation or adjustment involved.

How Cash Flow from Operating Activities is Calculated

Starts from Profit Before Tax value from the income statement.

Part 1: Adjustment for Non-cash expenses and earnings

- Add Depreciation and Amortization (D&A). This is added back as it is a non-cash transaction where there has been no cash outgo in the current financial year.

- Remove Interest income as this interest money is not considered as revenue from core operations. This interest income is shown under the section “Cash Flow from Investing activities” (Note: This may not apply to Finance companies and Banks, since “Interest Income” is part of their core operations)

Part 2: Adjustment in working capital

Changes in working capital, including current assets (excluding cash) and current liabilities, impact cash balance in operating activities. For example, when a company increases inventory, leads to a decrease in cash. Since it represents a cash outflow it is subtracted in the calculation of CFO.

Here’s a summary of how various working capital items affect cash:

- Accounts Receivable: Increase decreases cash; decrease increases cash

- Inventory: Increase decreases cash; decrease increases cash

- Accounts Payable: Increase increases cash; decrease decreases cash

Entries in the Cash Flow from Operations (CFO) section are the difference in these balance sheet entries between the current and previous years. While a detailed analysis of the balance sheet shows this link, it’s not essential for interpreting the Cash Flow statement.

Understanding that an increase in inventory leads to a cash outflow suffices without the need to validate inventory entries through balance sheet calculations i.e. Previous year Inventory – Current Year inventory. The focus is on an interpretation of numbers in the Cash flow statement and not validating the accuracy of the entries.

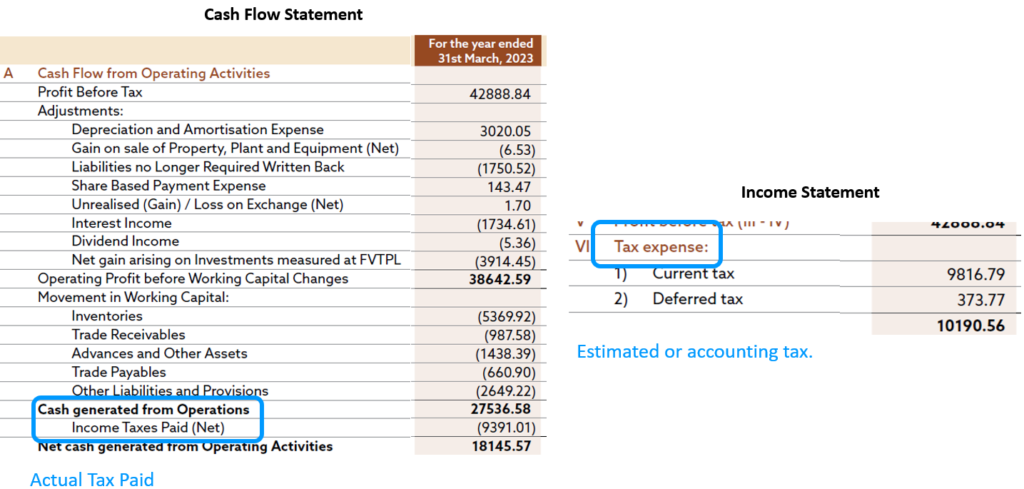

Part 3: Tax Paid

The taxes indicated in the Income statement is not the real amount paid. It is just an accounting tax value. The actual tax paid is indicated in the cash flow statement. This difference is obvious from the terms “Tax expense” used in the income statement and “Tax Paid” used in the Cash flow statement.

Below is an example of the above discussion from a real case balance sheet.

General Inference

Companies with strong growth in OCF most likely have a more stable net income, better abilities to pay and increase dividends and more opportunities to expand and weather downturns in the general economy or their industry.

Analysis of Cash flow from Operating Activities

This approach is best illustrated with a live case study, which will be featured in upcoming blogs. However in this blog, I share a few key pointers for investors to consider:

- Is the Cash Flow Negative?

- Is the Cash Flow greater (or less than) Net Profits in Income Statement? Reasons for the difference i.e. What components lead to higher (or lower) CFO than the Net profit?

- Higher positive Operating Cash Flow is favourable.

- Trend Analysis: How the cash flow looks over a 5 to 10 year period.

- Relate with other sections of the Cash Flow Statement, i.e. Investing and Financing activities.

Negative Operating Cash Flow is not Bad

- Not all cash flow statements exhibit a positive operating cash flow, but negative cash flow needs further analysis to understand the reasons.

- Sometimes, negative cash flow is the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future.

- This is why analysing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether or not a company may be on the brink of bankruptcy or success.

Begin the analysis with the initial line item, PBT, then proceed to assess each subsequent item to grasp its impact on the net OCF. However, simplifying the approach by focusing on the top 2 or 3 significant cash inflows and outflows is also effective.

We will understand more of this in detail with real cases, in the subsequent blogs.

Conclusion

Cash Flow from Operating activities serves as a cornerstone in financial analysis, offering invaluable insights into a company’s operational performance and financial health. By mastering the art of interpreting and analyzing Cash Flow from Operating activities, investors can gain a deeper understanding of a company’s ability to generate cash and sustain its operations over the long term. This analysis is an important toolkit that can enhance your decision-making process. In the next blog, we will understand in detail the Cash flow from Investing activities.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.