Cash Flow from Investing Activities provides critical information about a company’s investment in future growth and expansion. By analyzing the inflows and outflows in this section, investors can gain valuable insights into a company’s strategic decisions for future growth and potential future performance.

This blog explores the importance of Cash Flow from Investing Activities, its components, and how investors can interpret and analyze this information to get the inferences for the future growth plans.

Featured image credits: https://www.velotrade.com/blog/what-is-cash-flow-statement/

Below is a high-level overview of the blog contents.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might want to explore my other blogs that also delve deeply into the analysis of financial statements like Debt Equity Ratio, Revenue Analysis and Metrics for Dividend Analysis (Part 1 and Part 2)

Importance of Cash Flow from Investing Activities

The separate disclosure of cash flows arising from investing activities is crucial because these cash flows indicate the extent to which expenditures have been allocated for resources aimed at generating future income and cash flows. Additionally, only expenditures resulting in recognized assets on the balance sheet qualify for classification as investing activities.

This section shows the cash flow from sales and purchases of long-term investments, such as fixed assets encompassing property, plant, and equipment. Investors typically scrutinize capital expenditures, which are used for both maintaining and expanding a company’s physical assets to bolster its operational efficiency and competitiveness. Ultimately, investors gain insights into how a company invests in itself.

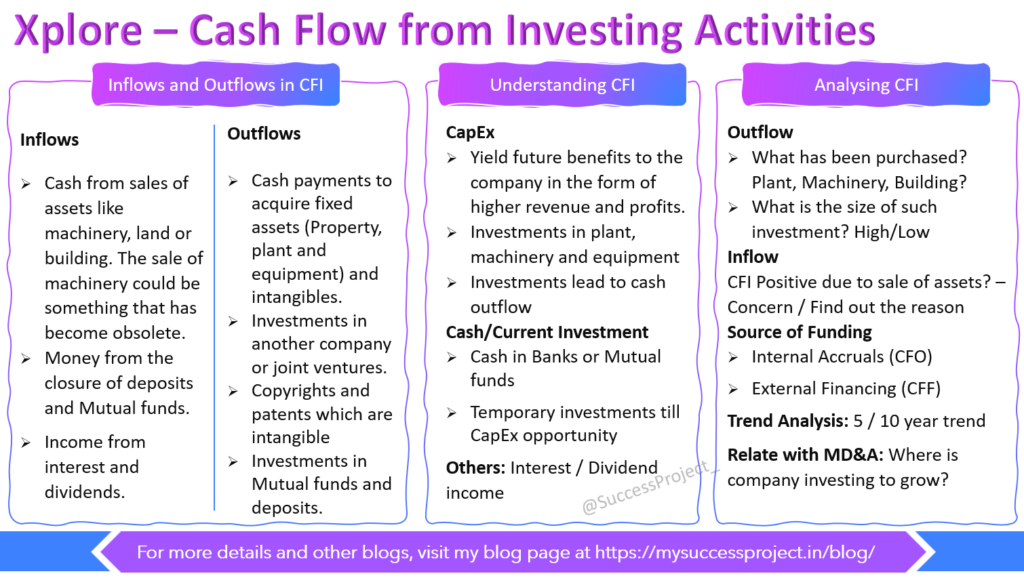

Understanding Cash Flow from Investing Activities

Cash flow from Investing activities is the second portion of the Cash Flow Statement. The first portion covers Cash Flow from operating activities. Cash flow from Investing activities covers;

CapEx

- CapEx represents a significant measure of capital investment by a company.

- CapEx is detailed under Cash Flow from Investing Activities and is expected to yield future benefits in terms of increased revenue and profits.

- An increase in capital expenditures signifies the company’s investment in future operations.

- CapEx leads to a reduction in cash flow, hence marked as negative number.

- Companies with substantial capital expenditures typically indicate a state of growth.

Short and Long Term Cash Investments

- Cash Flow from Investing Activities not only includes CapEx but also encompasses short-term (“Current Investments”) and long-term investments (“Non-Current Investments”) in Mutual funds or bank deposits.

- This reflects a situation where the company is seeking deployment of funds but awaiting suitable opportunities.

- Till such opportunities are identified they are invested in these avenues to make the best use of cash.

Others

The statement also covers other items like interest income, dividend income etc.

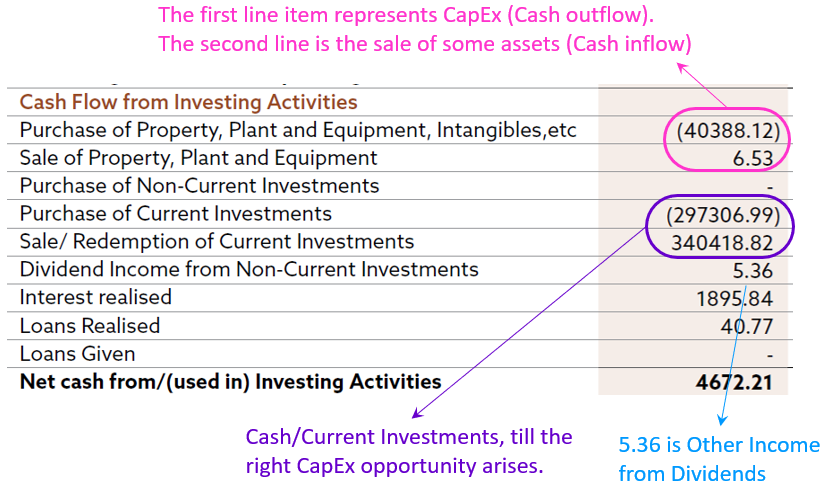

Below is a sample.

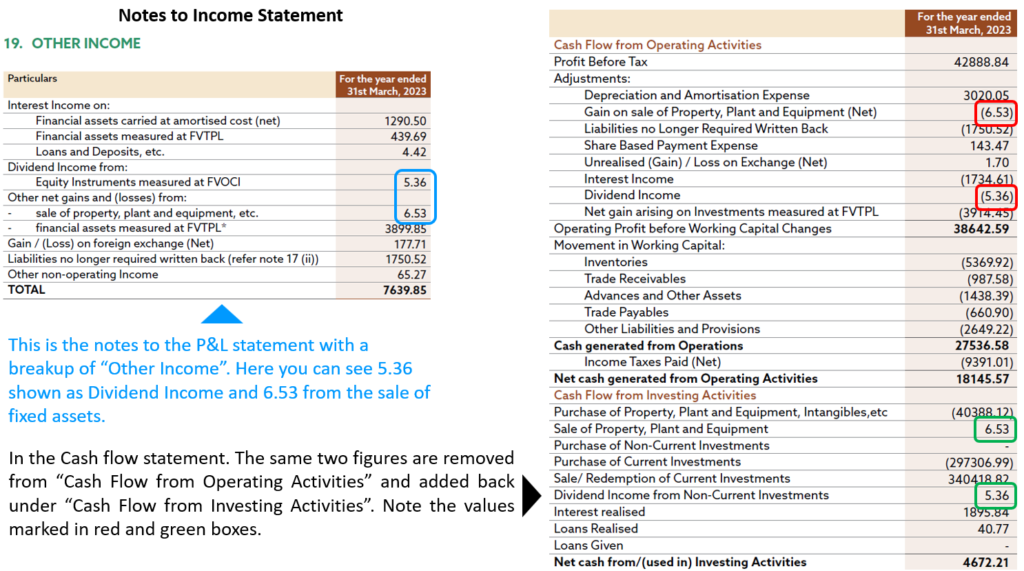

There is an interesting learning from the above image. Note the figures 6.53 and 5.36. These were shown as Other income in the Income Statement. The same has been reclassified in the Cash Flow Statement. Details in the below image.

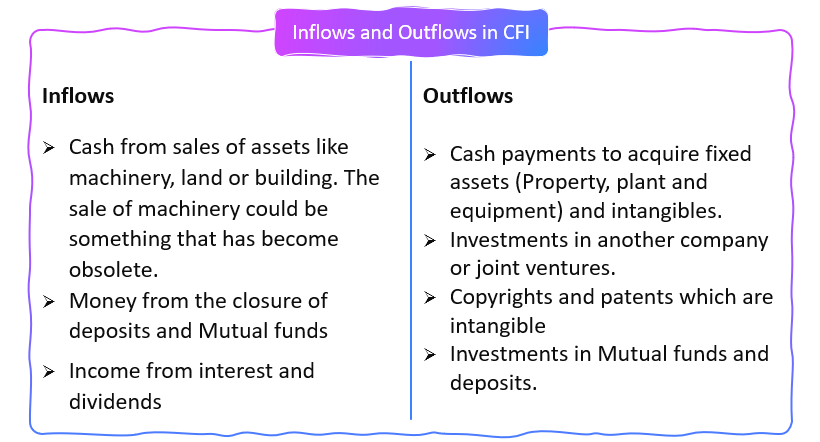

Understanding the Inflows and Outflows

The Cash flow from investing activities can either be inflow or outflow. The general pointers for Cash inflow and outflow activities from operations.

This is only a high level understanding. You may refer to IND AS7 for complete details.

Analysis of Cash Flow from Investing Activities

The Cash flow from Investing activities is a relatively smaller section when compared to Cash flow from Investing activities. So one can review all the line items in this section. Investors to look for:

Cash Outflow

- This could be due to purchase of long-term investments or fixed assets like Plant, Machinery and Property or due to Mergers & Acquisitions and joint ventures.

- Is the investment low relative to the size of the company? If Yes, then it could indicate

- Lack of future growth plan or opportunities

- Management may be treating the business like a cash cow, milking it for the cash it generates today and not investing in future growth.

- Is the investment very high relative to the size of the company? If Yes

- It may suggest that management has high hopes for the future of the company.

- However, there are two caveats (1) These investments need not be necessarily profitable in future, and (2) If such high investment is funded by huge external borrowing instead of internal accruals, then it could spell some trouble in future.

Cash Inflow

- This could be due to the sale of long-term investments or fixed assets

- Fixed assets usually may be related to scrap sales of old machinery or infrastructure.

- However, If the sale of such fixed assets is a big number leading to positive cash flow in Investing activities, then it needs investors’ attention.

- You need to find out the reason and long-term impact on the future earnings company. Such important topics will definitely will be covered in the annual report.

Source of Funding

- How is the investment funded? It is by debt or internal accruals?

- To get an answer related with other parts of the Cash flow statement

- One easy pointer is: Internal accruals come from operating cash flow while external funding is reflected in Cash flow from Financing activities.

- This insights helps to understand the company’s strategy for growth and stability.

Trend Analysis

- Study trends in Cash Flow from Investing activities over 5 or 10 years

- Consistent negative investing cash flow can be a healthy sign of a growing company which can give positive returns down the line.

- Declining investing cash flows may be signs of challenge in growth. It can be a signal that the company doesn’t believe there are potential opportunities in its current business.

Relate with Management Discussion and Analysis

- To make good quality inferences out of the CFI, relate the inferences with the MD&A section of the annual report.

- This helps to get a view of where the company is planning to invest or grow in next few years.

- You get to know if it is through additional plans or buying other companies etc.

I will demonstrate the above approach using a live case study in future blogs. This blog is intended to give a bigger picture, while the future blog will put this learning to practise. Stay tuned for future blogs, where we’ll delve into live case studies to demonstrate these analytical approaches and deepen our understanding of financial analysis.

Conclusion

Cash Flow from Investing Activities offers vital insights into a company’s investment decisions and future growth prospects. By analyzing this information alongside other financial statements, investors can better understand a company’s strategic direction and make informed investment decisions. Understanding the nuances of Cash Flow from Investing Activities empowers investors to assess a company’s future growth plans, means for funding and potential for long-term success.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.