As investors, understanding how a company raises and manages its capital is paramount to making informed investment decisions. Cash Flow from Financing activities (CFF) provides insights into a company’s financial structure, funding strategies, and shareholder relations. By examining the inflows and outflows associated with debt, equity, dividends, and share buybacks, we can gain a deeper understanding of a company’s financial health and future prospects.

In this blog, we will understand all the details of CCF.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might want to explore my other blogs that also delve deeply into the analysis of financial statements like Debt Equity Ratio, Revenue Analysis and Metrics for Dividend Analysis (Part 1 and Part 2)

Importance of Cash Flow from Financing Activities

The distinct disclosure of cash flows from financing activities holds significance as it aids in predicting future claims on cash flows by providers of capital to the entity. Moreover, this section encompasses the company’s debt and equity transactions, reflecting its interactions with capital markets and investors.

For investors, this section provides a plethora of insights on the financial structure of the company, its strengths, weaknesses, and its policy for rewarding shareholders. Additionally, investors can ascertain the frequency and amounts of capital raised from debt and equity sources, along with the repayment patterns over time.

Understanding Cash Flow from Financing Activities

The Cash Flow from Financing activities represents the final section of the Cash Flow Statement, following Cash Flow from Operating activities and Cash Flow from Investing activities. It illuminates the company’s financial structure and strategy, providing insights into whether the company

- Repays creditors,

- Rewards shareholders with dividends or share buybacks,

- Raises long-term loans for capital expenditures, or

- Secures short-term loans to meet working capital needs.

Analyzing these aspects reveals the company’s strengths, weaknesses, and future expectations. A positive number indicates that cash has come into the company, while a negative number indicates that company has paid out debt or rewarded shareholders.

Understanding the Inflows and Outflows

The general pointers for Cash inflow and outflow activities from Financing activities include:

- Cash inflow from equity (IPO or FPO) or preferential shares or debentures

- Cash inflow from debt (Banks or Lenders)

- Cash outflow by repaying creditors

- Cash outflow from Dividend payments or share buyback

- Any ouflow on related taxation i.e. Dividend distribution tax

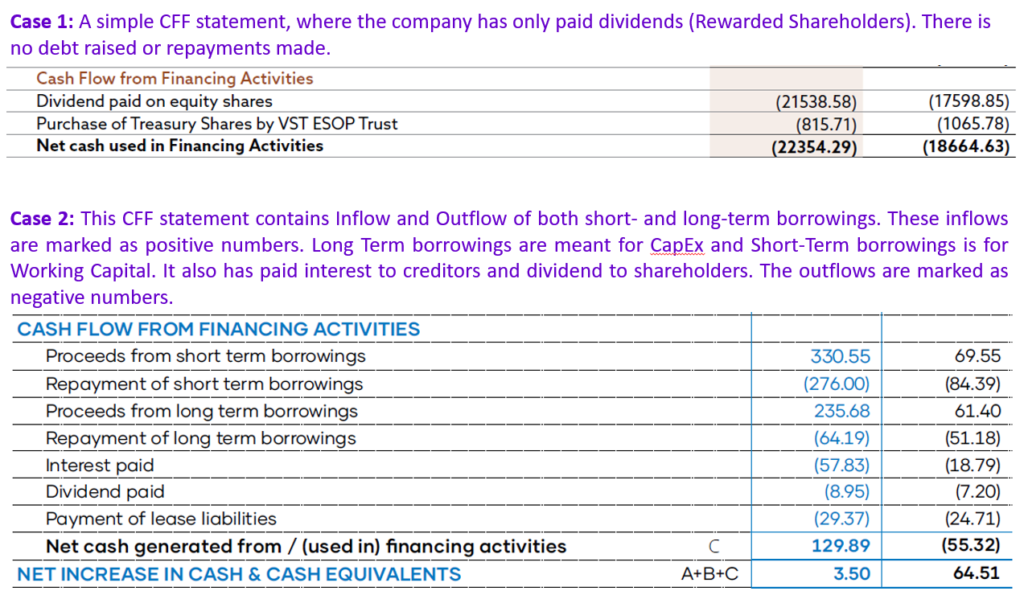

This is only a high level understanding. You may refer to IND AS7 for complete details. Given below are two samples for better understanding.

Analysis of Cash Flow from Financing Activities

The Cash flow from Financing activities is relatively smaller compared to the Cash flow from operating and Investing activities. Analyzing each line item in this section is essential.

Outflows and Inflows

- Cash Outflow due to Dividends or Share buybacks are reflection of rewarding shareholders.

- Cash inflow from debt (Long-term or short-term) or equity.

- Relate with other sections of the cash flow statement to check the uses of funds raised:

- Is capital raised to meet working capital demands? Occurs when OCF is low/negative

- Is capital raised to meet CapEx needs? This happens when OCF is insufficient for CapEx

Trend Analysis

- Study trends in Cash Flow from Investing activities over 5 or 10 years.

- Observe changes in capital structure of the company.

- Insights: Evaluate if the company has been consistently raising capital or rewarding shareholders.

- Consistent positive Financing cash flows and low (or negative) Operating cash flows suggest sub-optimal capital utilization, reflecting operational inefficiency and mismanagement.

- Consistently raising debt might be an unattractive investment option.

I will demonstrate the above approach using a live case study in future blogs. This blog is intended to give a bigger picture, while the future blog will put these learning to practise. Stay tuned for future blogs, where we’ll delve into live case studies to demonstrate these analytical approaches and deepen our understanding of financial analysis.

Conclusion

Cash Flow from Financing activities offers invaluable insights into a company’s financial health, capital structure, and strategic priorities. Moreover, by analyzing the patterns of capital raising, debt repayment, and shareholder rewards, investors can assess the company’s ability to manage its finances effectively and sustain long-term growth.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.