While scrutinizing financial statements, particularly the cash flow statement, can reveal invaluable insights into a company’s operational efficiency and strategic decisions. Investors are constantly seeking clues to understand Management’s strategy. This blog helps to identify bunch of such clues from the cash flow statement.

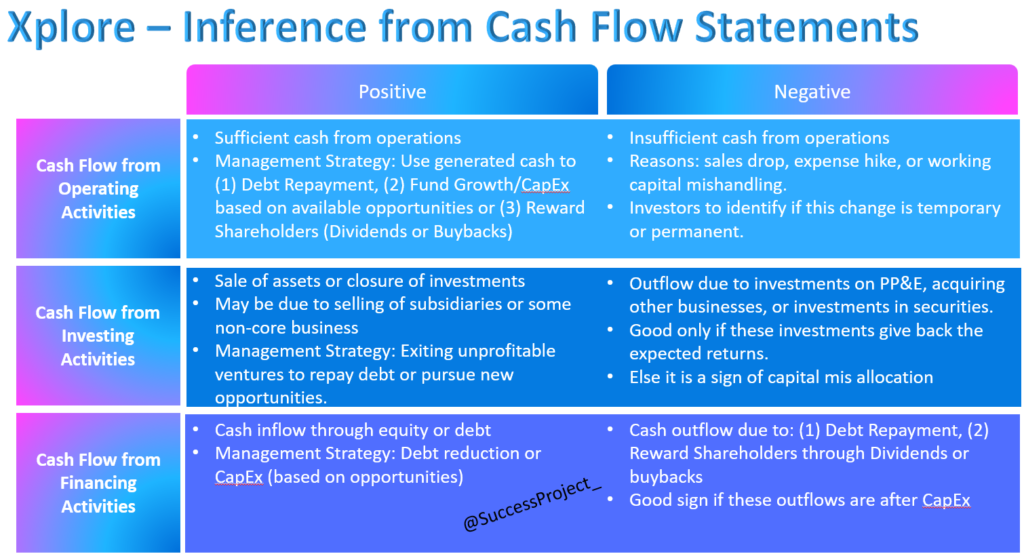

By simply observing whether Cash Flow from Operations (CFO), Cash Flow from Investing Activities (CFI), and Cash Flow from Financing Activities (CFF) are positive or negative, investors can gather lot of insights about management’s approach to handling cash, investment priorities, and financial health.

Dear Reader,

This blog is part of a larger series. For a comprehensive understanding of this blog, we recommend reading the previous blogs.

Simple, But Deep Dive a Must

The approach in this blog is not intended to oversimplify the cash flow analysis. It is aimed to merely to put the piece together i.e. Positive or Negative for CFO, CFI and CFF into a single window and gather inference. These inferences must be validated by deep analysis of Cash Flow Statement that we saw in the previous blogs and also connecting back to the other two financial statements, and the Management Discussion Analysis section of the Annual report.

Cash Flow Analysis, A Recap

To gain a deeper understanding of this blog’s content, it is advisable to review and comprehend the preceding three blogs, which cover:

- Cash flow from Operating Activities

- Cash flow from Investing Activities

- Cash flow from Financing Activities

Each of these cash flows can exhibit either a positive or negative trend, resulting in six potential scenarios: CFO+, CFO-, CFI+, CFI-, CFF+, and CFF-. Each scenario offers valuable insights into various aspects of the company’s operations, management strategy, financing, and growth trajectory, as discussed in the aforementioned blogs. The comprehensive summary provided below illustrates these scenarios.

By analyzing whether these cash flows are positive or negative, investors can uncover a wealth of insights. However, the analysis becomes even more profound when all three cash flows are interconnected, allowing for a more comprehensive understanding of the company’s financial dynamics. This holistic approach forms the central theme of this blog. Understanding the above is very much essential to get the most out of this holistic approach.

Note: Occasionally, the cash flows may exhibit marginal positivity or negativity. For instance, the CFO might only slightly exceed 0, perhaps by INR 50,000. These instances can be considered borderline cases, making it challenging to draw meaningful inferences. For example, a slight variance of -60,000 would render the CFO negative in the given example. In such scenarios, it is advisable to proceed with caution and formulate conservative interpretations.

8 Possible Scenarios

CFO+ CFI+ CFF+

With strong operational cash, positive investment inflows from divesting non-core assets or subsidiaries, and additional cash raised through financing activities, the company is bolstering its cash reserves.

This suggests a strategic move by management, potentially signalling intentions for future acquisitions.

However, concrete confirmation of this inference may only surface when the company formally announces plans for acquisition in the future.

CFO+ CFI- CFF-

Operating cash flows support cash outflow in investing and financing activities. The operating cash flow of the company is used: (1) To finance growth by investing in future growth and (2) Rewarding its shareholders (By way of Dividends or buybacks) and/or repaying its debt.

CFO+ CFI+ CFF-

Operating and investing cash flows together support cash outflow in financing activities. The company is generating operating cash flow and also selling its assets (and/or) redeeming its investments to repay debt. CFI+ may indicate that the company is exiting in some non core business.

CFO+ CFI- CFF+

Operating and financing cash inflows together support cash outflow in investing activities. The company is using the cash generated internally from its operations and also from external funding to support growth.

Investors should prioritize examining the expenses associated with external funding and the areas in which the company is investing for growth.

CFO- CFI+ CFF+

No cash inflow from Operations, but cash inflow from investing and financing activities. The operations are consuming cash which is supported by the sale of assets/investments and also raising money from shareholders and/or creditors.

Negative or cash outflow from operations is the first negative trigger. Selling assets & raising debt to fund operations is the second negative trigger. Since the sale of long-term assets does impact future earnings. Also raising debt affects future earnings due to interest outgo.

Investors must look at the previous year’s cash flow statements to identify if this has been a trend in the past. Generally, such companies are best to be avoided by long term retail investors.

CFO- CFI- CFF+

Positive cash flow from financing activities is crucial to supplement the outflow from operations and investing activities. Given the company’s insufficient cash generation from operations, it struggles to finance its investment ventures independently. Consequently, to fuel its growth aspirations, the company resorts to raising funds from shareholders and/or creditors.

Although this may not be an ideal scenario for investors, it’s a common occurrence among many young companies, especially those with novel business models or platform-based operations.

CFO- CFI+ CFF-

With positive cash flow from investing activities, the company manages the outflow from both operations and financing activities. This scenario presents a unique challenge as the company encounters difficulties on two fronts, (1) Generating cash from operations and (2) Raising money through financing activities. Hindered by limitations in borrowing, it resorts to selling long-term assets to sustain operations and meet debt obligations. This again is not a sweet spot for retail investor’s hard earned money.

CFO- CFI- CFF-

There is cash outflow in all three activities. The company does not having cash from operations, it is not able to raise money through financing but rather needs to meet debt obligations. It is also having outflow funding its growth ambition. This is not sustainable unless it has sufficient cash reserves in the balance sheets. Such situations are interesting to analyse what is happening in the company but not the best place to put investors’s money.

Conclusion

Understanding the interplay between cash flow from operations, investing activities, and financing activities provides investors with valuable insights into a company’s management strategy and financial health.

By merely analysing the CFO, CFI, and CFF at a high level investors can assess how effectively a company is managing its cash, allocating resources, and pursuing growth opportunities. This holistic approach is a powerful tool to decode a company’s management strategy. Whether it’s investing in growth opportunities, managing debt, or returning value to shareholders.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.