This blog will share the books, videos, and websites that have helped in my investment journey. When I first started as a beginner, I faced the challenge of not knowing which resources to rely on. I understand how overwhelming it can be to begin learning about these topics without proper guidance and a recommended reading sequence. That’s why I share this blog with all the valuable resources i.e. Books, YouTube Videos, Blog pages and websites, for other beginners who are just starting out. I hope you find my blog beneficial!

Featured image credits: https://www.pexels.com/photo/orange-trees-2734512/

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You will be interested to read more about me and the purpose of my website. Visit my Blog index page to view all my blogs.

Personal Finance

Personal Finance is basic financial education/knowledge which is a must for everyone must have before investing. A thorough knowledge on personal finance is a must for everyone, by the time they get their first salary or atleast before starting to invest. One must need to have knowledge on,

- Insurance: Insure your life, health, and assets

- Retirement Planning: You can get car loan, house loan, personal loan etc But one can never get a retirement loan So plan well for your retirement

- Goal based Planning: For short term 2 Years) and long term goals 2 Years)

- Taxation: Benefit from different Tax saving schemes, exemptions and deductions

- Emergency Fund: Life is full of uncertainty A Emergency fund saves your skin then. Click here for my detailed blog to learn about creating an Emergency fund.

- Succession Planning: No one knows when fate will over take us. One must plan for a smooth transition to their successor. Click here for my detailed blog on this subject.

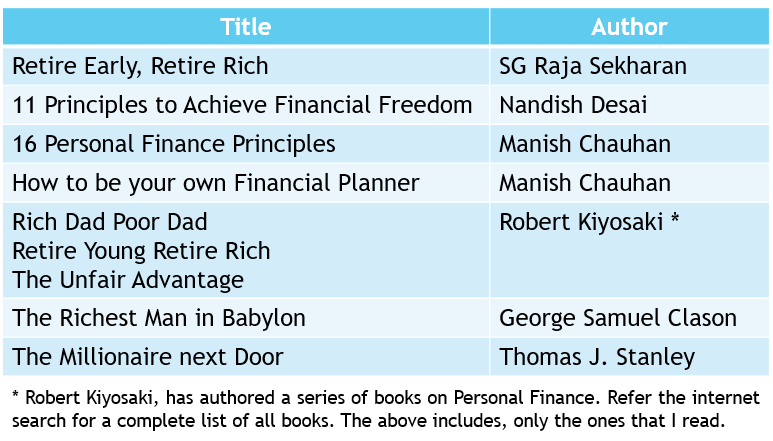

Given below is the list of books that helped me to understand Personal Finance better.

Below are the websites and blogs on Personal Finance:

- https://www.safalniveshak.com/ by Vishal Khandelwal

- https://www.stableinvestor.com/ by Dev Ashish

- https://ofdollarsanddata.com/

- https://www.basunivesh.com/blog/ by Basavaraj Tonagatti

- https://www.jagoinvestor.com/ by Manish Chauhan and Nandish Desai

- Investor Hangouts, a YouTube playlist by Dhirendra Kumar/Value Research with a series of videos covering all dimensions of Personal Finance.

Knowledge on Personal Finance is a very basic and a mandatory one. This must be understood well before understanding ideas related to Investing.

Stock Investing

The resources that I mention are for Long Term investing in stocks and not for trading and speculation, which are carried out for quick profits.

Annual Reports

The annual report is the sole published document that offers investors a comprehensive overview of the company’s progress. It includes audited financial statements, operational discussions from management, and a briefing from the Chairman. It is crucial to keep the following points in mind:

- Deciphering annual reports requires specialized knowledge and familiarity with industry jargon. However, it is not something impossible. It comes with practice.

- Annual reports provide investors with a financial snapshot of their stock holdings.

- Neglecting important details hidden in the fine print can have disastrous consequences for long-term investors.

Developing the skill to read annual reports, interpret their contents, and extract insights is essential for making informed investment decisions. This skill holds significant importance for long-term investors.

Vishal's Resource

Blogs

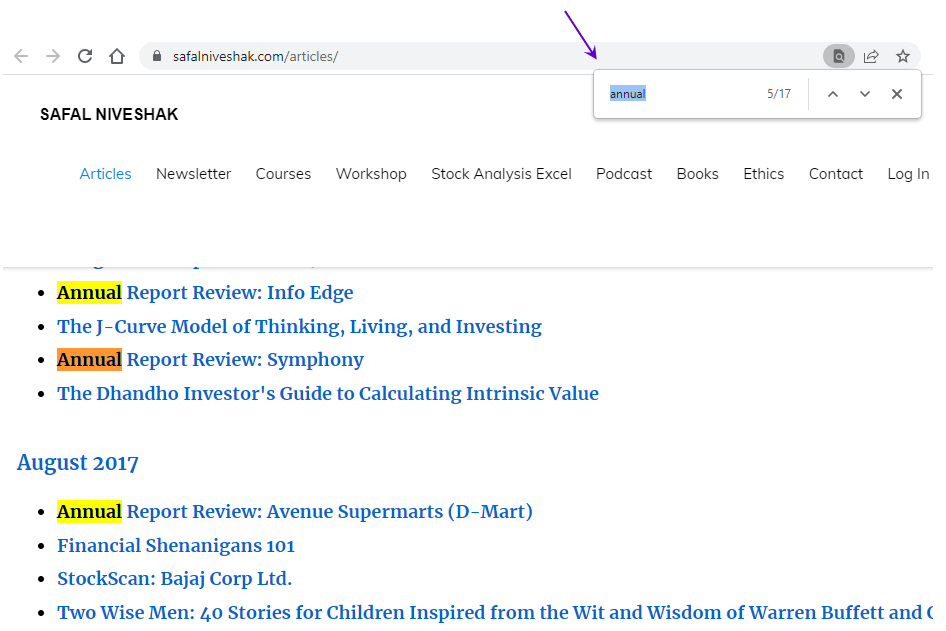

Mr. Vishal Khandelwal in this website https://www safalniveshak com/ has shared in-depth and practical understanding of reading Annual Reports. It has scanned copy of a few ARs with his observations.

How to get them?

- Go to this website page https://www.safalniveshak.com/articles/

- In the browser search with keyword “Annual”. Read the blogs written around “Annual Report”

Although these blogs and contents may be dated, they provide a practical experience of extracting valuable information from an annual report. They offer a hands-on exposure to the process of mining crucial data from these reports.

Videos

Vishal also has shared a good number of videos that would help to read Annual Report.

Other Resources

Financial Statement Analysis

The financial statement functions as a window that enables us to witness the happenings within a company. Accounting serves as the language of business. However, the ability to read financial statements and interpret their message is not possessed by many. To initiate your understanding, the following books are excellent starting points:

Books

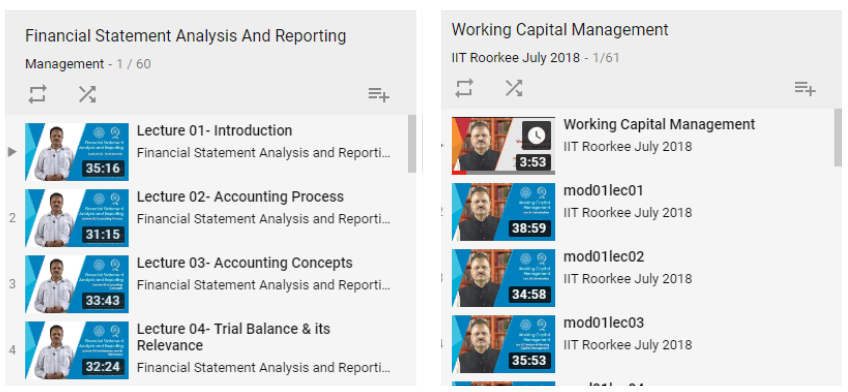

YouTube Videos

Tim Bennett

Both these channels collectively would have 200+ videos on Financial Statements and stock market basics.

Preston Pysh, These are a video series covering Financial Statement Analysis.

Aswath Damodaran

Investment Philosophies, a 40 part video series covering different aspects of stock investing including Financial Statement Analysis.

Professor Anil K Sharma

- Financial Statement Analysis And Reporting – This is a 61 part video series covering Financial Accounting and Financial Statement Analysis

- Working Capital Management

Website and Blogs

- Advanced Financial Statement Analysis by David Harper

- 101 Stock Market Metrics

- Wall Street Mojo, In this page, you will find almost anything that you want to know on Financial Statement Analysis

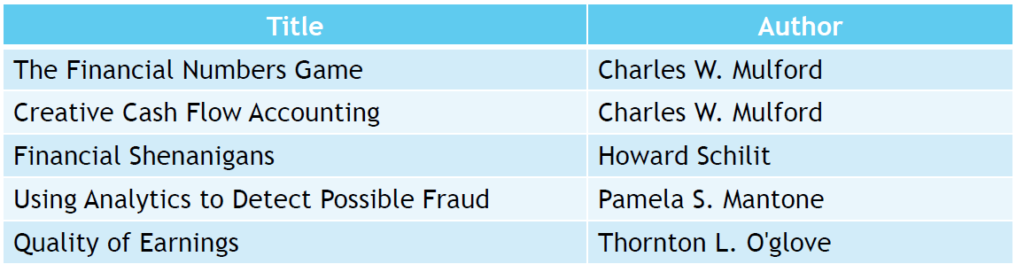

Accounting Forensics

Many individuals question the credibility of the numbers presented in the Financial Statements. They often inquire about the accuracy and reliability of the numbers.

Accounting Forensics, a specialized field of accounting, aims to uncover financial fraud. While these techniques are beneficial for investigators in detecting fraud and taking legal action, they are equally valuable for investors. Investors can utilize these techniques to determine whether the books of the companies they invest in are trustworthy.

Successful long-term investing relies on clean and transparent management practices and accurate financial reporting. Here are a few recommended books that can be valuable resources for investors.

Note: Understanding Financial Statements (Books in the previous section) is a pre requisite to understand the topics in this book.

Successful Investors, Fund Managers and Gurus

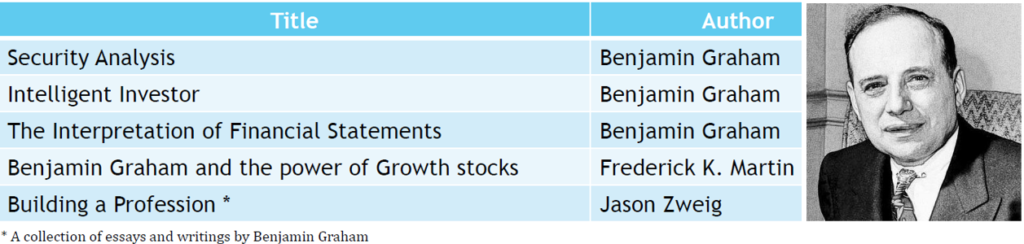

Benjamin Graham

Mr. Benjamin Graham, the founding father of investing, planted the seeds of today’s wisdom in the field almost a century ago. It is highly recommended to begin with his books as a first step before delving into other investment literature. Here are a few books authored or written by him that serve as essential reads for investors.

The below statement from Warren Buffett clearly emphasises the importance of the books of Benjamin Graham:

“There are three books in my overflowing library that I particularly treasure, each of them written more than 50 years ago All, though, would still be of enormous value to me if I were to read them today for the first time their wisdom endures though their pages fade They are the first editions of The Wealth of Nations 1776 by Adam Smith, The Intelligent Investor 1949 by Benjamin Graham and third is an original copy of the Graham and Dodd’s book on Security Analysis.“

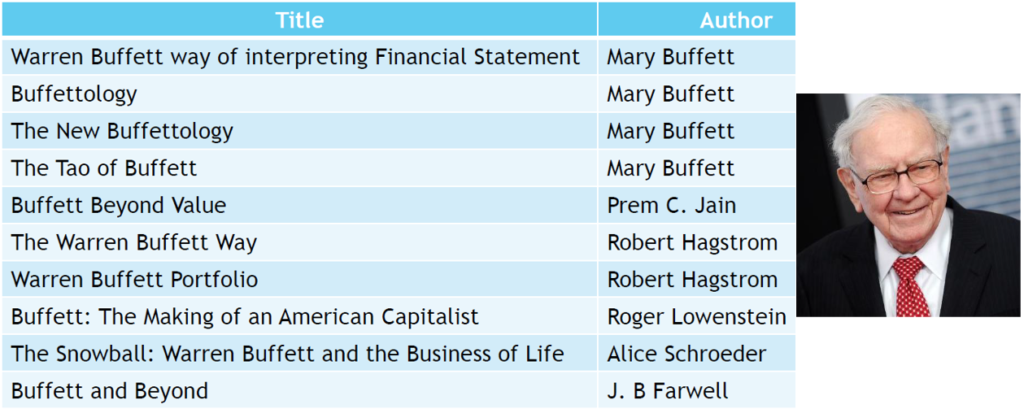

Warren Buffett

While Warren Buffett himself hasn’t authored any books, there is a wealth of literature available on him and his investment strategies. Here is a concise list of books that delve into the life and investment philosophies of Warren Buffett.

Note: The list by Mary Buffett is not complete Includes only the ones, that I have read A complete list of books authored by Mary Buffett can be seen at https://www.marybuffett.com/books/

Although Warren Buffett hasn’t authored any books himself, he has imparted his wisdom through his Partnership Letters, Berkshire Annual Reports, and annual meetings. These invaluable resources provide valuable insights into Buffett’s investment strategies and philosophy. Here are a few recommended resources to explore his wisdom firsthand.

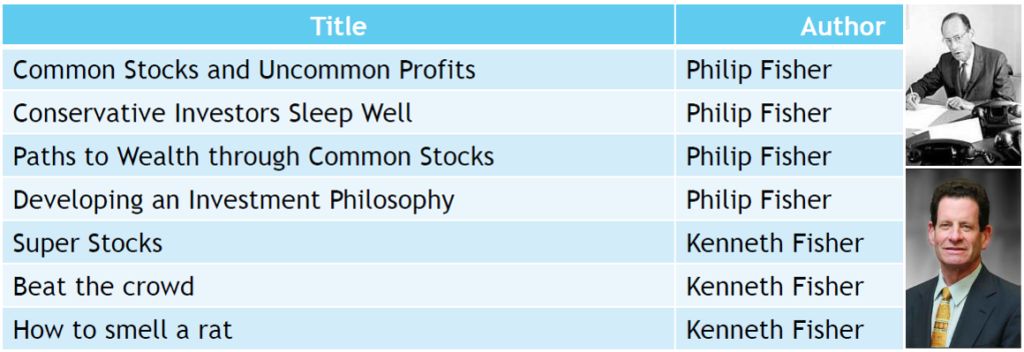

Philip Fisher and Kenneth Fisher

Philip Fisher could be considered a pioneer in the field of growth investing. Philip Fisher and his son Kenneth Fisher had shared their wisdom in their books listed below:

In Buffett’s own words. I am 15% Fisher* and 85% Benjamin Graham.

* Buffett refers to Philip Fisher.

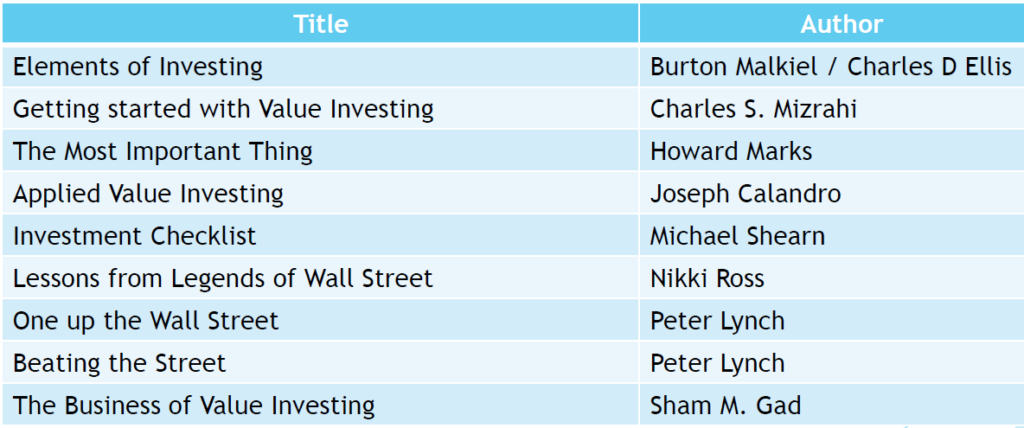

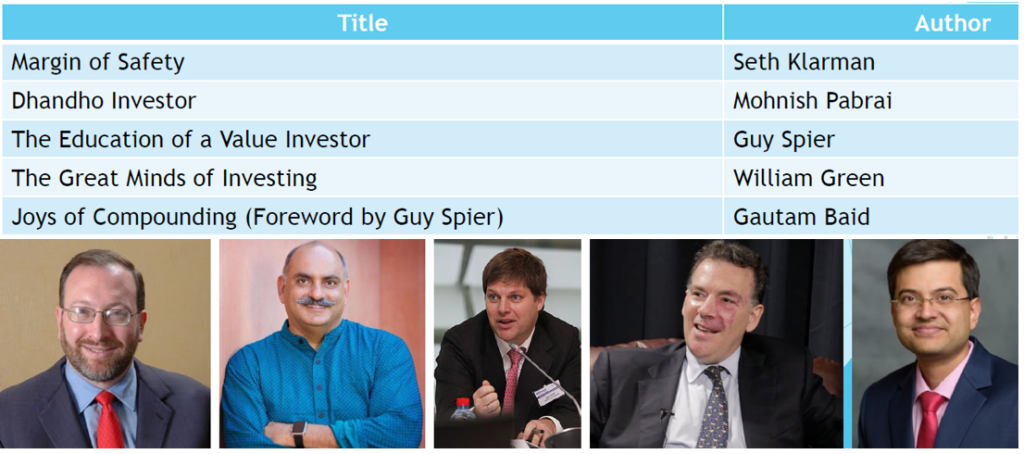

Investors and Fund Managers

Over the years, investing has undergone significant evolution. Renowned investors, gurus, and fund managers have formulated their unique philosophies and strategies. They have generously shared their ideas and wisdom through their books, making them accessible to aspiring investors. Here are a few highly recommended books from these esteemed individuals that offer valuable insights into the world of investing.

A note on Mohnish Pabrai…

The book “Mosaic Perspectives on Investing” is book/collection of 26 essays of Mohnish Pabrai written between 2001 and 2004. This link http://www.chaiwithpabrai.com/articles.html has Chapters of the book as downloadable pdf.

Other Resources

- Investors at Google, a Youtube Channel with 45 videos with talks by famous investors and fund managers.

- Gurufocus channel by Charlie Guru Educational videos of investing styles by different fund managers/investors

- 5 Good Questions by Jacob Taylor. Famous investors answer questions on investing.

- The Investor’s Podcast Network by Stig Broderson

- Howard Marks memos It is said that Warren Buffett read them first whenever his memos are released.

- MastersInvest by John Garret. It is a treasure trove for investors.

- The Greatest Investors, article by Investopedia on the 11 greatest Investors

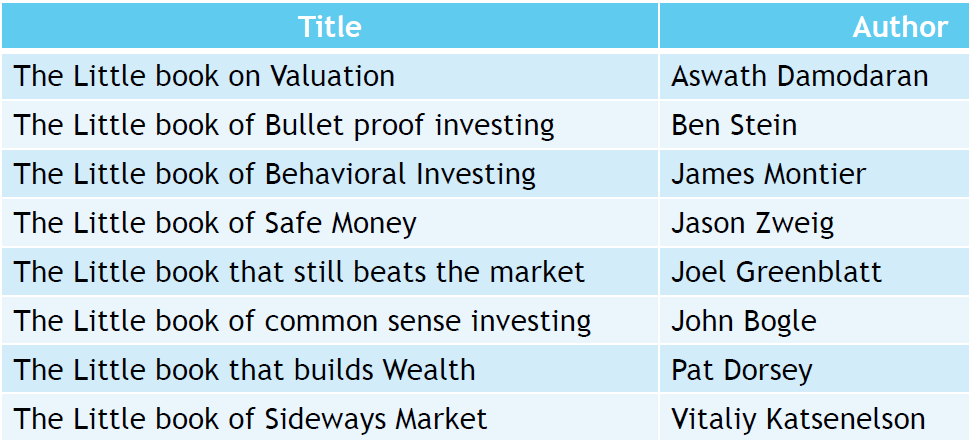

Little Book Series

You can easily read these little book series over the weekends or while traveling. New investors who are beginning their journey will find these books simple enough to understand. Please note that this is not an exhaustive list; it only includes the ones I have personally read. You can find a complete list of the “Little Book” series in the introduction or on the cover page of the above-mentioned books.

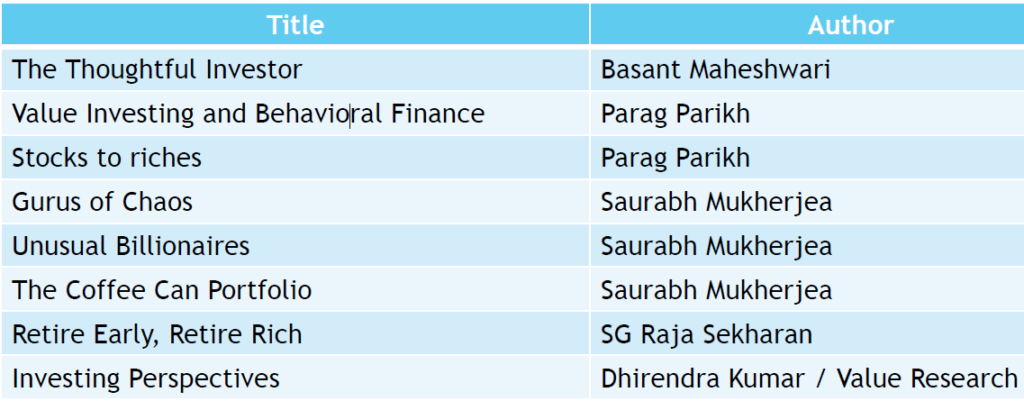

Stock Investing Resources in Indian Context

Books

The books/resources mentioned so far discuss the basics of investment and the ideas and strategies of famous investors. However, they may not provide a direct connection to the Indian context. In these books, you can explore the Indian stock market history, strategies, and themes that are relevant to the Indian context. They offer insights and perspectives tailored to the Indian market.

Blogs

- https://www.safalniveshak.com by Vishal Khandelwal. The Website by Mr Vishal Khandelwal would be useful for all level of investors The contents ranges from investing, behavioral finance, interviews of famous investors, educational articles and many more

- https://www.stableinvestor.com/ by Dev Ashish

- https://janav.wordpress.com/ by Jana Vembunarayanan

- https://fundooprofessor.wordpress.com and https://www.sanjaybakshi.net/media/ by Sanjay Bakshi

- http://www.valuepickr.com/ by Donald / Ayush

- http://www.richifymeclub.com/ by Dhruv

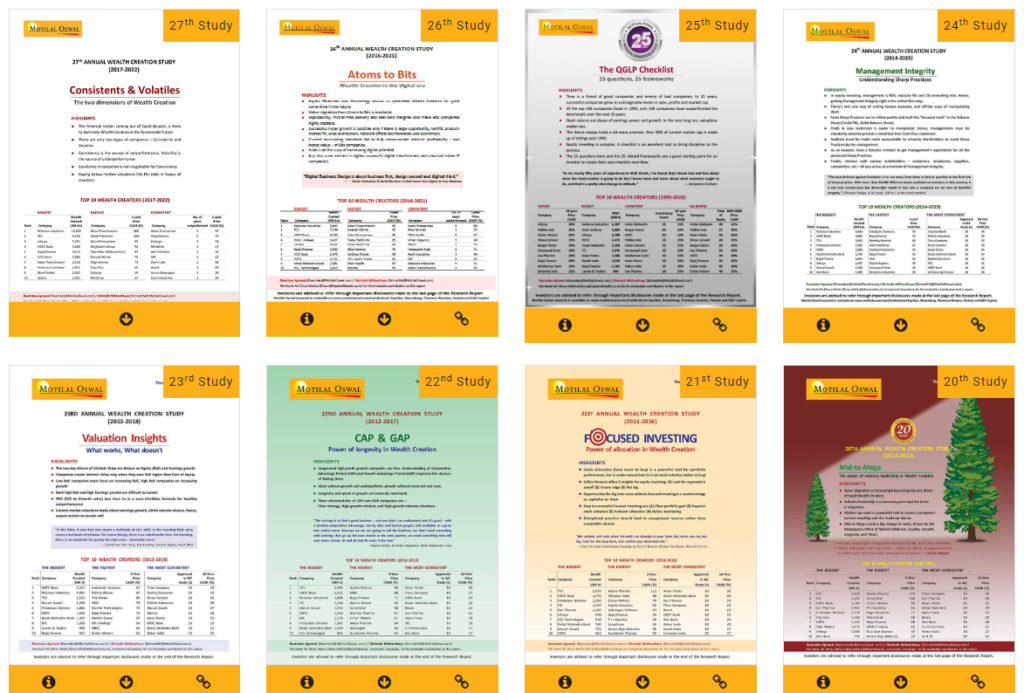

Wealth Creation Studies by Raamdeo Agrawal

Investors were always looking for an investment philosophy or a magic formula to make money consistently. This search led to the Wealth Creation Studies in 1996. Raamdeo Agrawal spends two months every year improving the formula through these studies. He reads many books to help him in wealth creation studies. Each year a theme is chosen for study. The biggest help or input comes from the books.

Investors can download the report of these studies from this link.

In recent years, Mr. Raamdeo Agrawal has been live streaming the Wealth Creation Studies on social media platforms. The videos can be found in the YouTube playlist, “Wealth Creation Study.” During the event, he presents the theme of the study and shares his insights. Subsequently, there is a fireside chat with other investors or top management personnel from different companies, who share their views on the study. Notably, these fireside chats have featured participation from eminent investors such as Shri Rakesh Jhunjhunwala and Sanjoy Bhattacharyya in the past.

Resources by Venkatesh Jayaraman

These are my own resources that I have created as blogs. These are multi-part blogs with specific theme.

Understanding the Diagnostic Industry

Understanding the Industry

- Understanding the Diagnostics Industry

- Overview of Indian Diagnostics Industry

- Diagnostics Market Segment Overview – Part 1

- Diagnostics Market Segment Overview – Part 2

- Details of Pathology and Radiology Segment

Insights for Investors

- PPP Model in Diagnostics

- Competition in Diagnostics Industry

- Insights for Investors covering Pricing, Accreditation, Preventive Diagnostics and Hub & Spokes Model

- Diagnostics Industry, Growth Opportunities

- Trends in Diagnostics Industry, covering Growth, Technology and Business trends

- Porters’ 5 forces analysis

- Market drivers for Diagnostics Industry

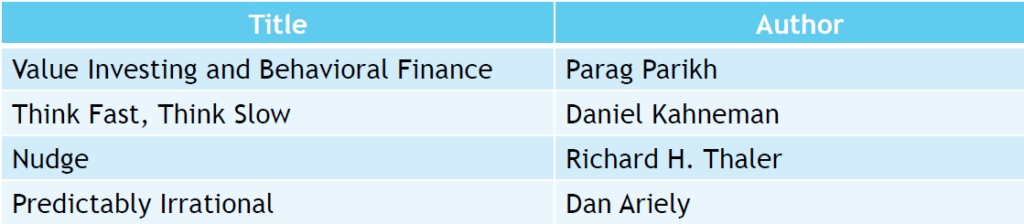

Behavioral Finance

It is often emphasized that investment success relies 10% on effort and a significant 90% on our own behavior. Being mindful of our behavior is crucial in achieving favorable outcomes. There are several books that delve into this aspect, offering valuable insights and guidance. These books shed light on the psychology of investing, self-discipline, emotional intelligence, and the importance of maintaining a rational mindset when making investment decisions. By exploring these recommended resources, we can gain a deeper understanding of the role behavior plays in our investment journey and learn strategies to cultivate the right mindset for long-term success.

Other resources would be:

- 12 part video on Latticework of Mental Models by Anshul Khare

- Behavioral Finance, Biases, Emotions and Financial Behaviour by Investopedia.

To Conclude

In conclusion, embarking on the journey of stock investing requires knowledge, understanding, and continuous learning. In this blog, I have shared various books and videos that have been instrumental in expanding my understanding of the stock market. From classic works by investing legends to contemporary resources offering insights into the Indian context, these resources have provided me with valuable guidance and perspectives. Remember, investing is a lifelong learning process, and it is essential to keep exploring new resources, staying updated with market trends, and adapting strategies accordingly. By delving into these recommended resources and continuously expanding your knowledge, you can enhance your investment acumen and make more informed decisions in the dynamic world of stock investing.